The Main Principles Of Custom Private Equity Asset Managers

Wiki Article

Our Custom Private Equity Asset Managers Ideas

You have actually most likely become aware of the term personal equity (PE): investing in firms that are not openly traded. About $11. 7 trillion in possessions were handled by private markets in 2022. PE companies seek possibilities to gain returns that are far better than what can be attained in public equity markets. Yet there may be a couple of points you don't comprehend regarding the market.

Private equity firms have a variety of financial investment preferences.

Because the ideal gravitate toward the bigger bargains, the center market is a considerably underserved market. There are much more sellers than there are highly experienced and well-positioned finance specialists with substantial buyer networks and resources to handle an offer. The returns of personal equity are generally seen after a few years.

6 Easy Facts About Custom Private Equity Asset Managers Shown

Flying below the radar of big international companies, most of these little business usually provide higher-quality customer support and/or specific niche services and products that are not being used by the large corporations (https://giphy.com/channel/cpequityamtx). Such upsides bring in the rate of interest of personal equity firms, as they possess the insights and smart to manipulate such possibilities and take the company to the following degree

Exclusive equity capitalists must have trusted, qualified, and reputable management in place. The majority of managers at portfolio business are given equity and reward settlement frameworks that award them for hitting their economic targets. Such positioning of goals is typically needed before an offer obtains done. Exclusive equity chances are usually out of reach for people who can't invest numerous dollars, yet they should not be.

There are regulations, such as limits on the accumulation amount of money and on the number of non-accredited capitalists (Private Equity Firm in Texas).

Examine This Report on Custom Private Equity Asset Managers

An additional negative aspect is the absence of liquidity; as soon as in a personal equity transaction, it is challenging to get out of or market. There is an absence of versatility. Exclusive equity likewise features high charges. With funds under management currently in the trillions, personal equity companies have actually ended up being eye-catching investment automobiles for rich people and organizations.

For decades, the attributes of exclusive equity have made the possession course an appealing proposal for those who could participate. Now that accessibility to personal equity is opening approximately more private investors, the untapped capacity is coming true. The inquiry to take into consideration is: why should you spend? We'll begin with the primary debates for buying exclusive equity: Exactly how and why exclusive equity returns have actually historically been more than other properties on a variety of levels, Just how consisting of private equity in a portfolio affects the risk-return account, by helping to diversify against market and intermittent risk, Then, we will outline some key considerations and threats for exclusive equity capitalists.

When it concerns presenting a brand-new property into a portfolio, one of the most standard consideration is the risk-return profile of that asset. Historically, private equity has exhibited returns similar to that of Arising Market Equities and greater than all other traditional property courses. Its reasonably low volatility combined with its high returns makes for an engaging risk-return profile.

Not known Details About Custom Private Equity Asset Managers

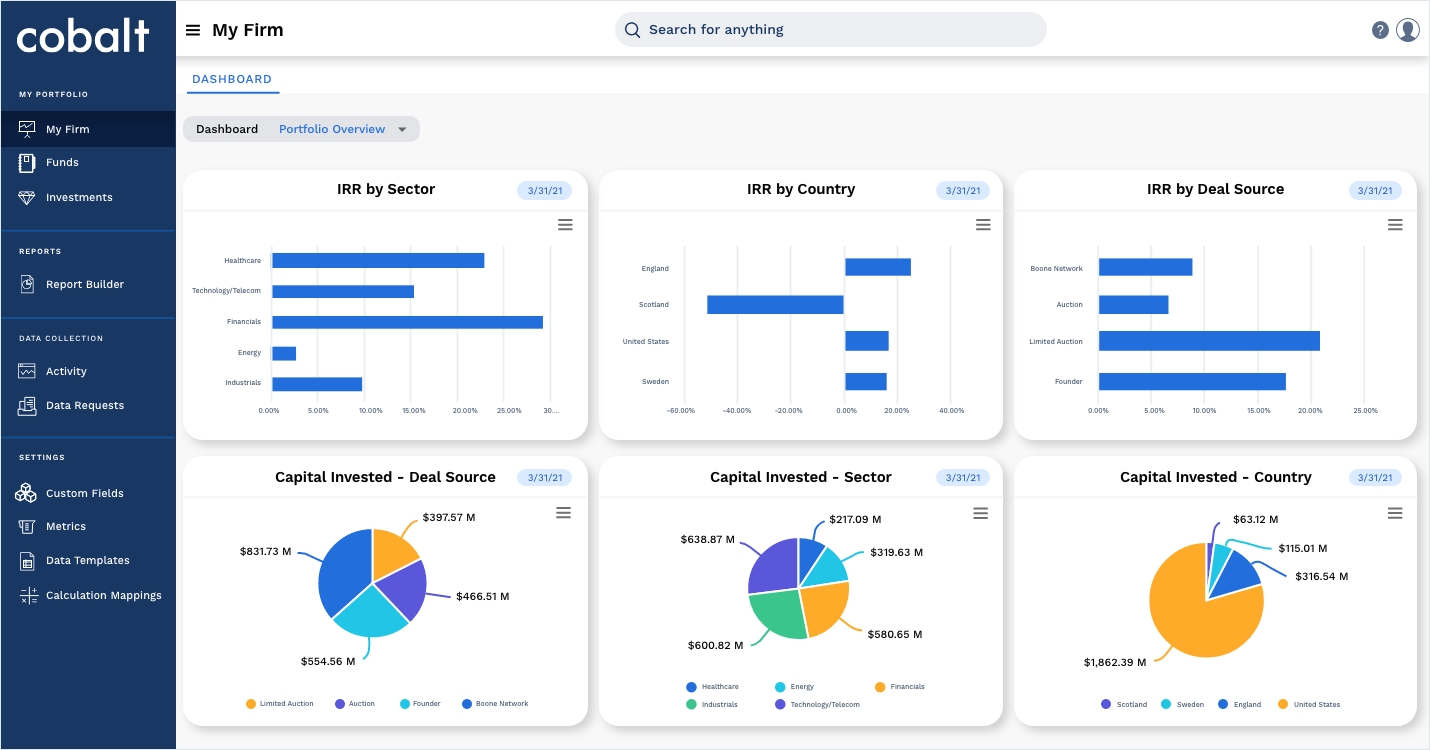

Actually, exclusive equity fund quartiles have the best variety of returns throughout all alternate possession courses - as you can see below. Approach: Interior price of return (IRR) spreads determined for funds within classic years independently and then balanced out. Median IRR was calculated bytaking the standard of the typical IRR for funds within each vintage year.

The result of including private equity right into a portfolio is - as constantly - dependent on the profile itself. A Pantheon study from 2015 recommended that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the other hand, the most effective exclusive equity firms have access to an even larger swimming pool of unknown possibilities that do not encounter the very same examination, along with the sources to perform due persistance on them and identify which are worth buying (TX Trusted Private Equity Company). Spending at the first stage suggests greater risk, however for the firms that do prosper, the fund advantages from higher returns

Little Known Facts About Custom Private Equity Asset Managers.

Both public and exclusive equity fund managers commit to investing a portion of the fund however there remains a well-trodden problem with lining up passions for public equity fund management: the 'principal-agent issue'. When a financier (the 'major') hires a public fund supervisor to take control of their funding (as an 'representative') they pass on control to the manager while keeping ownership of the possessions.

Get More InfoIn the situation of exclusive equity, the General Companion doesn't simply earn a monitoring fee. Exclusive equity funds additionally mitigate one more type of principal-agent issue.

A public equity capitalist ultimately desires one point - for the management to boost the supply rate and/or pay dividends. The investor has little to no control over the decision. We showed over the number of personal equity methods - especially majority acquistions - take control of the running of the firm, ensuring that the long-lasting worth of the business comes initially, rising the roi over the life of the fund.

Report this wiki page